August Earnings Report

Full P&L on each of our businesses and the path to multiple streams of income

August was a busy month

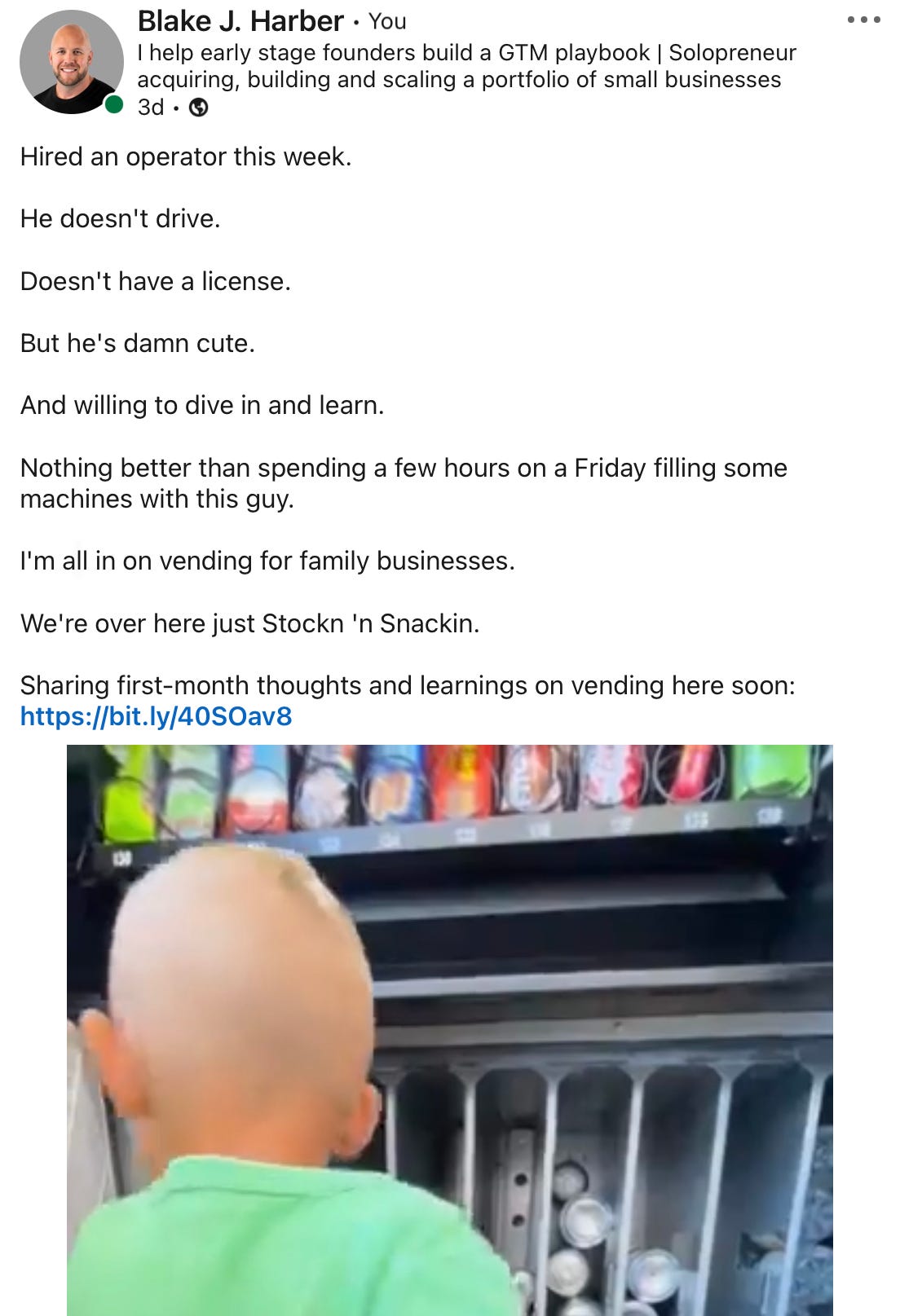

First full month operating StocknSnack Vending.

Vending has turned out to be one of my favorite side hustles / family businesses.

We’re in the process of transiting the operations from myself to my wife and kids fully.

Regardless, it only takes ~8 hours a week.

Pretty sexy, un-sexy small business.

If you’re new here, I’m honored you’re following a long.

Quick background:

~10 months ago I decided to not go back to a full time job.

I was tired. 10 years of building high growth Saas companies will burn most people out. I wasn’t sure how I was supposed to get my head right and do it all over again after only a few months break.

I felt emotionally distant from my kids and like a slave to my job. Hell, I didn’t even have one at the time but the looming burden of going back brought back all the feelings.

I wanted freedom.

Freedom to choose when to work, how to earn money, who to work with wherever I wanted and the ability to change directions at any given time I wanted to.

I wanted to own my calendar again. Not have to be at the mercy of a boss who could schedule calls until 10pm in the evening. Then slack me again at 7am the next day.

I get it, that’s a tall ask. But I believed it was possible.

I’m sure many of you can relate.

With some renewed courage and emotional energy at the opportunity of working for myself and setting real boundaries, I dove in 100% into consulting.

Between January 2023 and March 2023 I brought home $69,675 with over 96% margin.

By April, I was working ~3 days a week and doing >$40,000 a month.

I was so fortunate to learn the ins & outs of how to package up a service offering and sell what I’ve learned in my career that scaled.

FYI - I’ve packaged up all these learnings into a course. I believe most of you that want to try your hand at building a service business as a side hustle, can.

I believe you should.

Because in the world we live, you never know when your income will get cut off.

If your employer decided they don’t need you anymore, you’re income could be gone over night.

I’m offering my readers 75% off, only for a few more days

Get it here for only $99 now.

Then, in June LinkedIn deleted my account.

“Permanently”.

Here’s all the details of that shit show:

I was permanently banned from LinkedIn

My entire business hinges on communications via LinkedIn. Like, every facet. Content, lead flow for consulting, networking, recruiting and so much more. All I could imagine was: “If a CEO is talking to their friend and suggests they work with me, how will they find me? How will they look me up?”

I was devastated. It was my main source of lead gen for consulting.

All I could think was, “what if a CEO is trying to refer me to another CEO and they can’t even look me up on LinkedIn….” And “how will most people even get in touch with me”…

Think about it. If you were fired today and couldn’t use LinkedIn to find your next job, it’d probably be pretty painful.

I realized in that moment that I couldn’t wait any longer to diversify my income.

I had 1 source.

I realized it could get cut off without a moments notice. Something that would have been 100% out of my control.

At this point I was starting to look into SMB acquisition. I had been following Codie Sanchez for nearly a year but always assumed I’d be a bystander just watching and reading how others do it.

I realized this was the path forward.

I remembered a friend that I was introduced to back in January. We had lunch together.

He told me how he was acquiring $1M - $3M Saas companies that were profitable and growing 30%-40% a year.

Not sexy. (At least is what I thought back then)

But I was blown away at his philosophy.

He said, “Blake, if we acquire 3 of these each year and hire operators to take growth to 50% a year… we’ll be a $100M portfolio in just a few years”…

I couldn’t stop thinking about this comment for 3 months straight.

It sounded too simple.

It led me down the rabbit hole of HoldCo’s via SMB acquisitions.

The more I learned, the more I realized this path was for me.

To build a $10M a year business via a holding company made up of 4-5 companies that are highly profitable across multiple industries and reduce my dependency upon 1 business and 1 income.

Which has led me to today.

✍️ #2 under LOI.

Building it all in public.

Below are the details on the first full month of multiple streams of income.

It’s small, but we’re taking 1 step at a time.

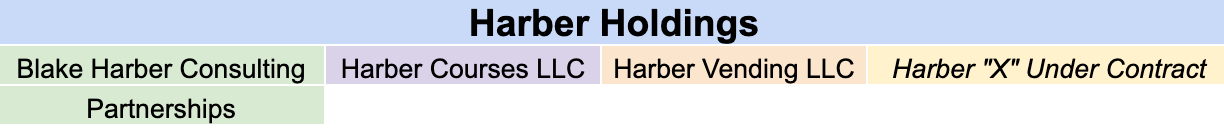

‘Harber Holdings’ isn’t quite a thing yet… we’ll be forming a hold co. as of 2024. Right now each of these operate as separate LLCs.

Regardless, this is how we’ll structure it:

Harber Holdings:

Gross Revenue: $60,771

Net Revenue: $52,741

Number of income streams: 4

Consulting:

Gross: $48,800 (80% of Total Gross)

Net: $46,356 (87.8% of Total Net)

Vending:

Gross: $10,151 (16.7% of Total Gross)

Net: $4,568 (8.6% of Total Net)

Partnerships:

Gross: $1,350 (2% of Total Gross)

Net: $1,350 (2.5% of Total Net)

Courses:

Gross: $470 (.07% of Total Gross) small but mighty ;-)

Net: $470 (.08% of Total Net)

Obviously consulting is the significant driver here of top line revenue.

With that said, I’ve scoped down consulting significantly starting September due to the anticipation of this acquisition going through. Should end September ~$20k on consulting. This will allow me to focus time on due diligence for this second acquisition.

I’m taking on smaller clients with smaller scopes and fewer clients in general. This should allow me to dedicate the time to closing this deal and getting onboarded into the new business through the end of year.

If this deal goes through, it should add ~$1M to the top line with ~33-40% net margins after debt service.

The main goal is to figure out how to get multiple businesses to $20k a month net. I don’t have any other specific goals other than that. I plan to see how this pivot is going for the next few months then come up with some solid vision for Jan 2024.

A few key learnings that I’ll be sharing in upcoming articles:

➡️ Due diligence period - what all goes into due diligence, how I’m structure and outlining my due diligence period to work towards closing and what a timeline looks like from LOI signed to closing date

➡️ Financing - I get SO many question about financing. It’s a learning curve to understand what’s available but I’m deep in it right now. I’ve taken notes of each type of financing, options available, how much they cost and how to find capital to work with for any acquisition. I’m far from an expert, but will share what I’ve learned during this rodeo.

➡️ A complete outline of resources for SMB acquisition - I’ve teased this a bit in the past but have gotten more questions recently about it. I just haven’t had the time to structure it together in a great way yet. I have countless books, articles, LOI templates, due diligence docs templates, final contract templates, lenders available with details on what type of lending they offer and much more.

I’m not quite sure how to share it all out, if you have any ideas please reply here with any thoughts. I’d love to be able to provide access to all this as a database for people who are searching for their first acquisition.

Thanks for following a long and if you wouldn’t mind please share this with anyone you think would find this interesting.

In regards to sharing and organizing your info Notion is an amazing tool. You can create Wiki’s & Sub pages and also add documents in one central place! Also it’s visually appealing!