I’m buying a service business, here’s how I’m sourcing my first acquisition

Bizbuysell isn’t they way to go, there’s a different way...

It’s no joke sourcing your first deal.

There’s literally a million different niches I could buy into.

How do I make sure I’m buying something that’s a ‘platform’ that I can tuck in other deals in the future for?

How do I know what is a good fit for me?

Do I want something mostly passive or am I willing to dedicate time to this each week? How much time?

I realized quickly I needed to get clear on what I wanted.

Get clear on your ‘buy box’

A buy box is your criteria of what you want to buy. This is a much harder exercise than you’d expect. Here’s what I’m learning that matters:

How much in SDE do you want?

SDE is what the owner takes home each year from the business. Valuations are typically a multiple of the SDE (sometimes described as EBITDA)

SDE of <$200k will be a cheaper business ($400k - $600k in value) but it’s likely that the owner you’re buying from is owning AND operating the business

SDE of >$400k - $500k means there’s likely a team in place to support the business. You’ll need to know how to manage people and develop leaders in the space. These businesses will also be $1M - $3M for sale.

For now, here’s my buy box:

SDE between $400k - $800k (plan is to reinvest most of this back into the business to fuel growth)

$1m - $3m in gross sales

10+ years old

In the Western US

Absentee or semi-absentee owner (I’m assuming this’ll give me the chance to become more involved in the business in a capacity that I want to)

Team in place with a #2 person that will stay around with a good comp package

Industry: Service based, home services, ideally B2B

What isn’t working

If you’ve ever gone through this process you’ll probably recognize the challenge I’m running into.

Day 1: scour Bizbuysell for good listings. Spend 2 hours, submit requests for more information on 4 deals

Day 2: You hear back from 1 of the 4 deals and the broker is asking for proof of funds. You message them back

Day 4: The broker was busy and just got your email. They asked to hop on a call to vet you further

Day 6: you have a call with the broker, they are really vetting to see how serious you are about buying a business. They will send you an NDA on the business you requested info on

Day 7: they finally get around to sending you the NDA, you sign it immediately.

Day 8: The broker or their assistant send you more details on the business. Within 5 minutes you realize that the SDE they listed on the website isn’t totally accurate and there’s some weird details in the business that are enough red flags that it’s probably not worth your time spending any more time……..

All for 1 deal.

It’s a mess.

I 100% get why so many people that start down this path of acquiring a business and give up after 30 days…

Or spend 12 months doing this same thing with no success.

All while keeping a full time job.

Sourcing a Deal

Online Sources

Bizbuysell is a joke. Same with Loopnet, acquire.com and most other listing sites.

Everyone and their mom are on it. Anyone can see, call and get access to these deals. At this point, I’ve had ~20 calls about deals on here and 95% of them are not good deals.

I thin it becomes a last resort for brokers to list.

The reality is, the good brokers have buyers they know who have liquid capital and are already in this game.

These are the buyers that get to see the best deals.

I’ve realized quickly that I need to get in front of those brokers.

All that being said, these sites are good for 1 thing: getting familiar with what the hell you are / should be looking for.

A few specifics that I’ve learned are key to hone in on:

Valuations (anyone can ask for anything, it’s good to understand the industries and multiples floating around out there)

SDE (what kind of margins to expect in each industry)

Industry

Sourcing brokers who have deals

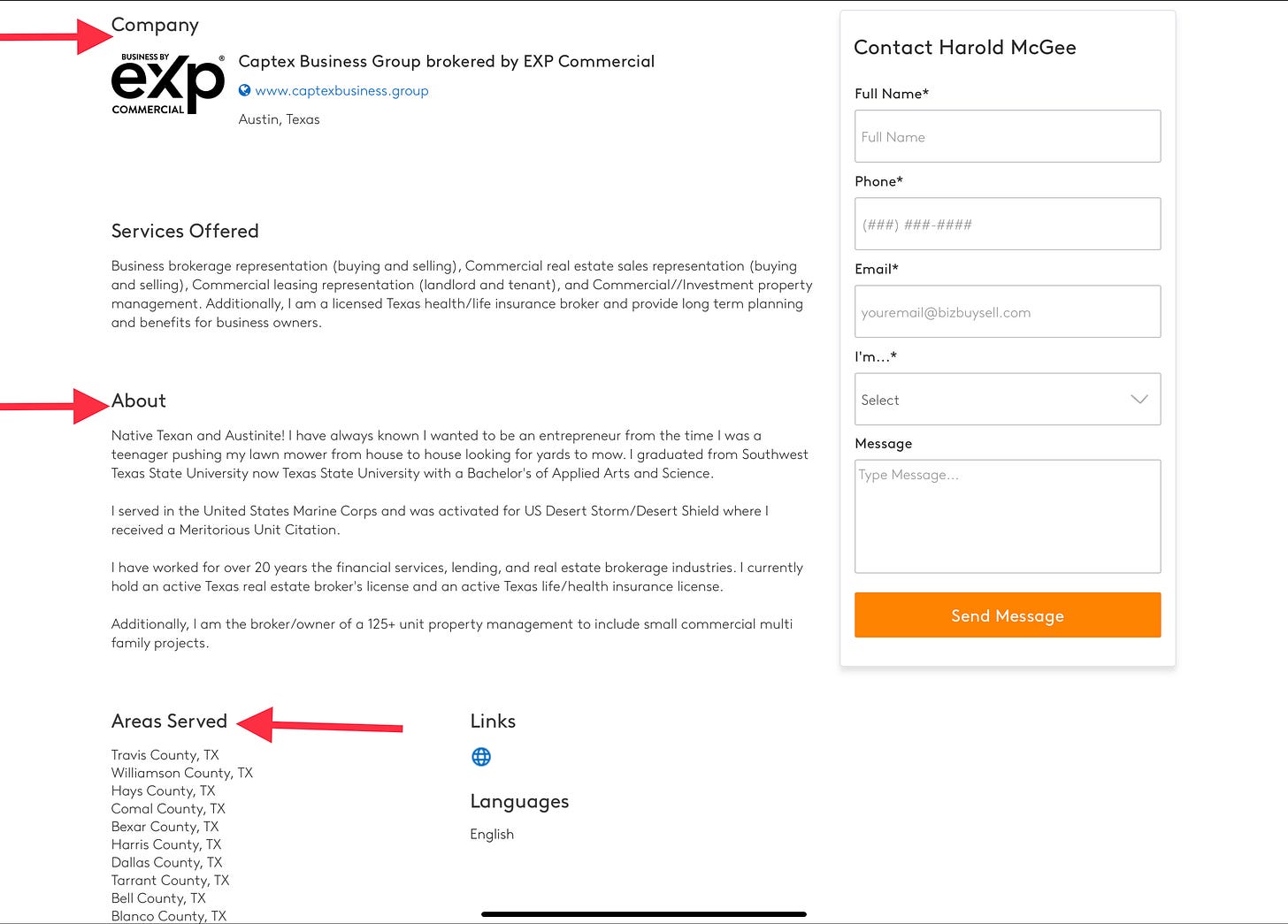

The best thing that Bizbuysell can do is tell me who has listings and which brokers I should be talking to.

When you open a listing, you can click on the broker on the right side.

You can get their phone number, membership associations and the group they work for.

Then I’m confirming that they are moving deals. Check out what they’ve sold and that they have a lot of listings.

I’m also hoping to find something in the western region so a flight is with 3 hours.

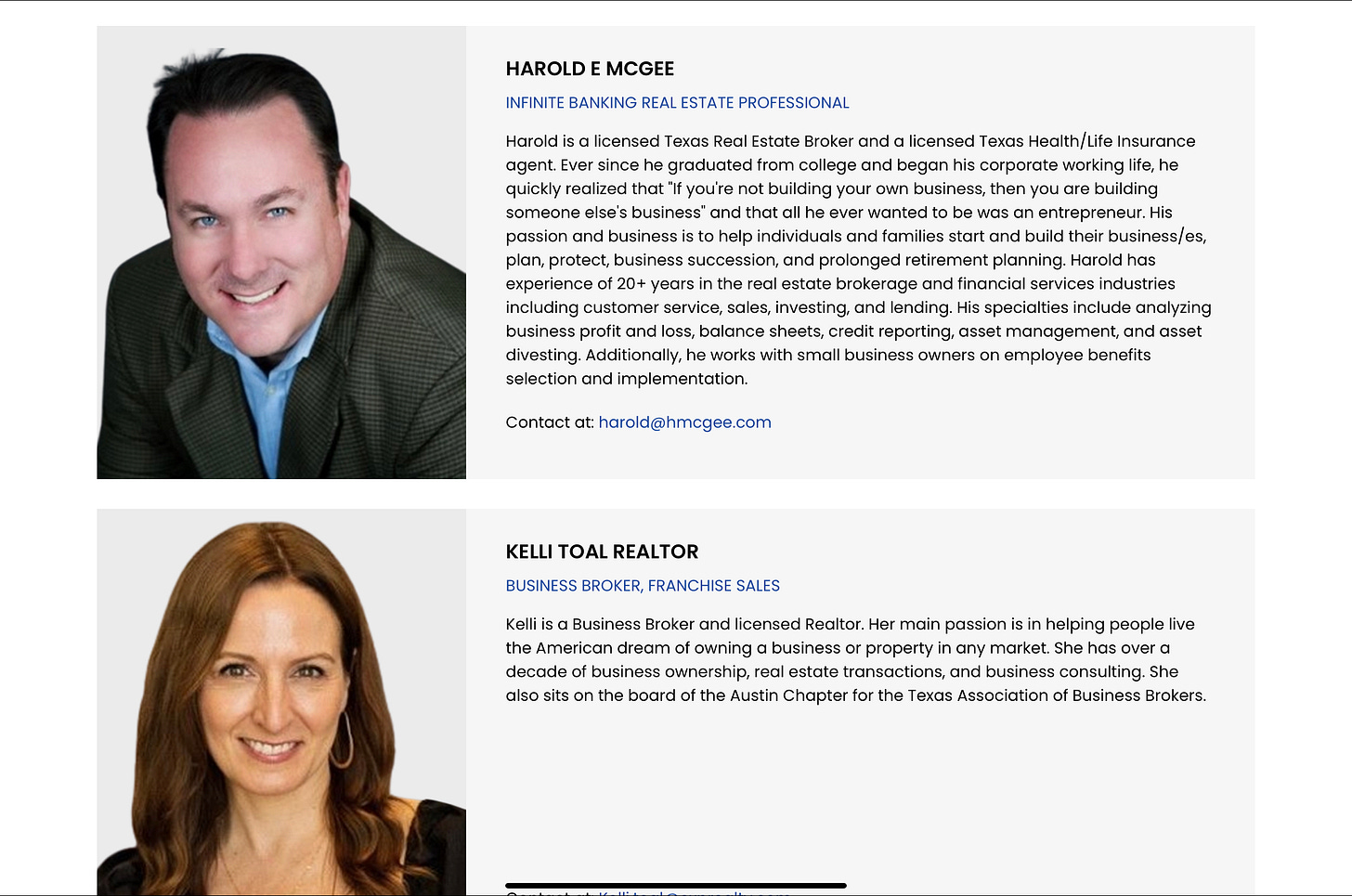

This example I’m using shows that his guy is an expert in Texas as all his listings are in the same area. This gives me confidence he’s hearing about deals as soon as they are coming available.

You can also confirm that the firm he works for is legit and moving a lot of deals in your target buy box and serving the areas I’m open to buying in.

I could be wrong, but I think a broker that can hone in on a single state or county will have access to deals faster than a national broker could.

In the bottom section, I can find a few brokers that are just like him.

Most profiles are not as good as this brokers on Bizbuysell.

But this one is a gold mine. Within a few minutes, I have ~10 brokers in a defined region that I can reach out to.

When I click into their website I can find personal emails easily.

In my opinion, if business brokers have any friction in finding a way to contact them, I’m going to guess they don’t have very good deal flow.

Cold Broker Outreach

If I’m a broker, I’m wanting to talk to 1) sellers of businesses that are ready to be listed ASAP and 2) Buyers that are serious, have capital ready to deploy and urgent.

After scouring Bizbuysell for 30 days and submitting tons of requests on things I didn’t have a ton of intentions of leaning into anyways…

I’ve realized that I need to sell the broker on working with me and bringing me deals first before anyone else.

I’m starting with the cold call. Here’s what I’m including:

Who I am

What I’m looking for as described above (as specific as possible)

Telling them I have proof that I have capital to deploy (bank statement with sufficient funds for at least 25% down payment if necessary) and will email it over

Why I’m wanting to purchase in the next 90 days (significant tax write offs, long term goals of building a holdco, putting money to work this year, etc)

They are usually suggesting 1 or 2 deals immediately.

My ask: to get eyes on any deals before they go to market with the promise that I’d reply within a few hours when they send me one.

Showing my intent

I’ve spoke to many brokers in the last few weeks.

I’ve asked many of them for feedback on how I can stand out and show my intent over other buyers.

There’s 3 consistent answers:

Try to get face to face. If possible,

When you sign a NDA and they send details on the business, reply to the email with more detailed questions about the business, why you might be interested or why not

When you are no longer interested in the business, reply as fast as you can to let them know which ones you’re not interested in and why

Doesn’t seem that hard.

But it makes sense. 6 months ago when I was slowly ‘starting’ to look, I’d sign NDAs on anything just to see details on the business, then never reply.

Resources for self-funded searchers

There’s a lot of information out there, it’s hard to know where to look.

I’m putting together a single notion doc with all the resources I’m gathering on sourcing a small business including:

Niche listing sites

Niche brokers

M&A details for SMB specifically

Podcasts, books and other readings that have been game changers

Details on each step of the process

If this is interesting to you, let me know by replying to this email. I’d love to hear what else would be helpful to include.

📚 I’m launching a course on selling your services online and building your side hustle while still holding a full time job. I get 10 people a week wanting to learn how I’ve built a consulting business. It’s the main reason I built it in public.

I’m packaging up everything I know into a single course including how to source deals, how to price and package your offering and how to build a repeatable monthly income stream while still working.

If you’ve ever wanted to try selling your knowledge and expertise, I’ll walk you through step by step on my journey to >$40k a month in 90 days.

Check it out here on pre-sale for 75% off: https://www.blakeharber.com/offers/o3Yh6nTc/checkout

Just wanted to say this was a really high signal-to-noise post. Thanks for sharing

Great details here and I like how you break it down. My buddy is an acquisition entrepreneur and told me all about this pain.

Appreciate you posting about this and looking forward to reading more as well as the notion doc!